Diligent Junior and Senior Stock Equity Picks

At Royalty Gold Corp., we pride ourselves on a meticulous selection process for both junior and senior stock equity picks. Our experienced team harnesses deep industry knowledge to thoroughly analyze every potential investment opportunity. This involves conducting comprehensive due diligence with the respective company’s management, assets, and growth potential, to ensure we only invest in companies with the most upside potential. From emerging junior companies with promising exploration projects, to well-established senior mining producing corporations with a proven track record of performance, our portfolio is a testament to our unwavering commitment to quality and reliability. Choosing to invest with Royalty Gold Corp. means entrusting your exposure with precious metals, to experts in the precious metals equity space.

Orphan Precious Metal Royalties

At Royalty Gold Corp., we have a keen eye for 'orphan' precious metal royalties. These are lucrative, yet often overlooked, royalty interests in exploration projects that may have been ignored due to various reasons, such as complex corporate structures, management, precious metals price, or lack of exploration and development activities. Our expert team's ability to identify, acquire, and optimize these untapped assets is part of what sets us apart in the gold royalty sector. By integrating orphan precious metal royalties into our diversified portfolio, we add another layer of potential for future royalty income. With Royalty Gold Corp., even the neglected corners of the mining industry can yield glittering returns.

Metal Stockpiles for Optionality

At Royalty Gold Corp., we understand the importance of optionality in an investment strategy. Therefore, we continuously seek strategic metal stockpiles, which may provide cash flow with future metal extraction, or act as an optionality play, giving a valuable edge when market conditions fluctuate. These stockpiles, are often comprised of gold and silver resources from previous mine operations. Trust in Royalty Gold Corp. for prudent resource management and adaptable investment strategies.

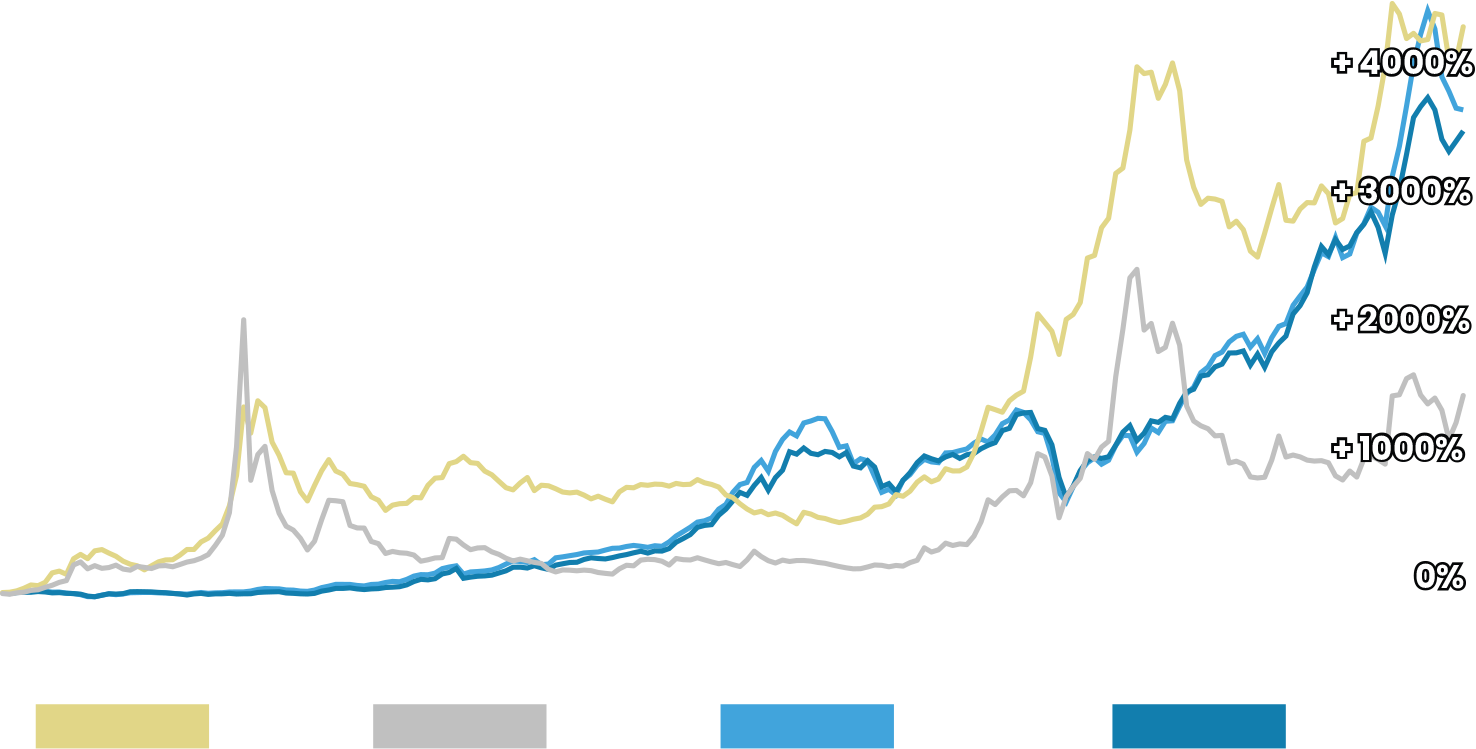

S&P 500 vs. Dow Jones vs. Gold vs. Silver

Conversion of Cash to Physical Metals

In our effort to diversify assets and increase investment stability, Royalty Gold Corp. implements a strategic approach of converting a portion of our cash reserves into physical metals. This strategy acts as a hedge against currency fluctuations, inflation, and market volatility, providing a robust foundation for our financial health. Physical gold holds its value over time, creating a reliable store of wealth that underpins our commitment to safeguarding our investors' interests. By balancing our holdings between cash for liquidity and gold for stability, we are better positioned to navigate economic cycles and deliver consistent returns to our stakeholders. With Royalty Gold Corp., rest assured your investment is in secure hands.